Medicare Explained: Just How to Maximize Your Medical Insurance Perks

Navigating the world of health insurance policy can be frustrating, especially when it comes to Medicare. With its various parts and coverage options, comprehending just how to maximize your health and wellness insurance policy advantages can seem like a daunting task. Fear not, due to the fact that in this extensive guide, we will certainly stroll you with the fundamentals of Medicare, from eligibility requirements to choosing the best strategy and maximizing your benefits. Whether you're new to Medicare or wanting to optimize your present coverage, this discussion will certainly provide you with the knowledge and devices to ensure you're getting the most out of your medical insurance. Let's dive in and uncover the keys to unlocking the full capacity of your Medicare advantages.

Eligibility Needs

To receive Medicare benefits, people have to satisfy particular qualification demands described by the federal government. These needs are made to ensure that Medicare is available to those that truly require it, while also preventing abuse and abuse of the program. The qualification standards for Medicare are mostly based on age, impairment status, and citizenship or residency.

The most typical way to end up being eligible for Medicare is by getting to the age of 65. People who have actually worked and paid Medicare taxes for at the very least one decade are instantly eligible for Medicare Component A, which covers medical facility insurance. They may additionally pick to enroll in Medicare Part B, which covers medical insurance coverage, and Medicare Part D, which covers prescription medications.

However, people under the age of 65 might also be qualified for Medicare if they have certain specials needs or certain medical problems. These individuals have to have received Social Security Special needs Insurance Policy (SSDI) for a minimum of two years or have actually been diagnosed with end-stage kidney condition (ESRD) or amyotrophic side sclerosis (ALS)

Lastly, to be qualified for Medicare, individuals need to be either an USA person or a lawful resident who has lived in the country for at the very least five constant years. Evidence of citizenship or residency is needed when making an application for Medicare benefits.

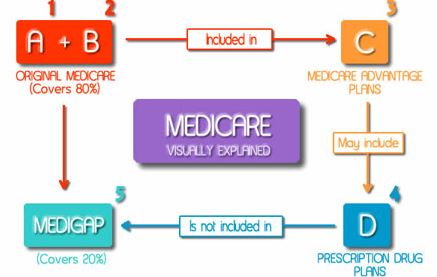

Various Components of Medicare

Medicare is composed of a number of distinct components that give various kinds of health insurance coverage. Recognizing the various components of Medicare is necessary for people who are signed up or preparing to enlist in the program.

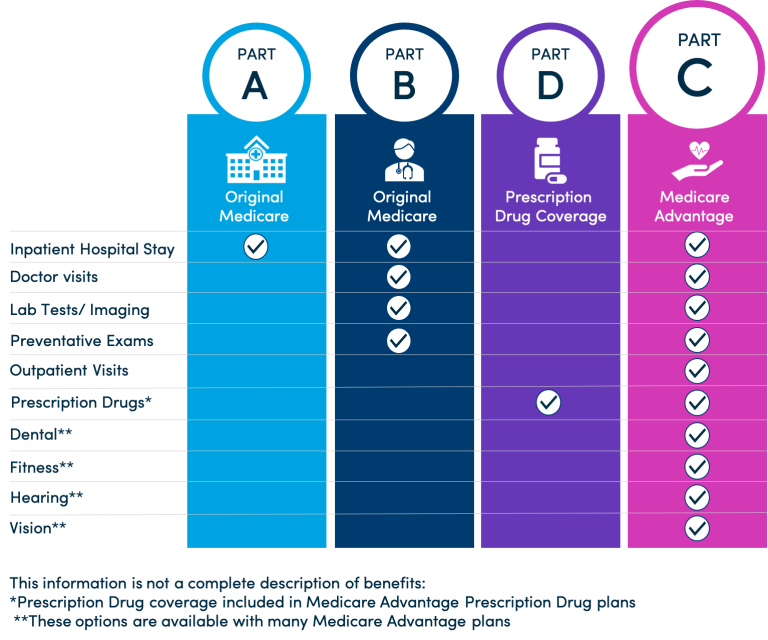

Medicare Part B, on the other hand, covers outpatient clinical solutions such as medical professional sees, preventative services, and medically required products. Component B calls for individuals to pay a monthly costs and fulfill an annual deductible before the insurance coverage starts.

Medicare Component C, additionally referred to as Medicare Advantage, is a different to Original Medicare (Components A and B) It is given by private insurer authorized by Medicare and supplies fringe benefits such as prescription medicine insurance coverage and oral treatment. Medicare Advantage plans often have network restrictions and need people to pay copayments or coinsurance for protected solutions.

Finally, Medicare Part D gives prescription medicine coverage. It can be gotten by enlisting in a standalone Component D strategy or with a Medicare Benefit plan that includes prescription medication coverage.

Selecting the Right Plan

When thinking about Medicare protection alternatives, individuals need to thoroughly review and pick the plan that ideal matches their details health care demands. With several various strategies offered, it is vital to recognize the functions and advantages of each in order to make a notified choice.

Among the very first factors to think about is whether to select Original Medicare or a Medicare Advantage plan. Initial Medicare contains Component A (medical facility insurance policy) and Component B (medical insurance coverage), while Medicare Advantage prepares, likewise called Component C, are supplied by personal insurer and frequently include prescription drug coverage (Component D) also.

Individuals need to also think about their current wellness condition and any details clinical requirements they may have. As an example, if they need constant expert sees or prescription medicines, a plan with extensive insurance coverage and a vast network of carriers may be preferable. On the other hand, people who are normally healthy and do not right here call for frequent healthcare might opt for a strategy with reduced costs and out-of-pocket expenses.

In addition, it is necessary to evaluate the prices associated with each strategy, consisting of costs, deductibles, copayments, and coinsurance. By meticulously contrasting these expenses, individuals can identify which strategy uses one of the most thorough and economical insurance coverage for their medical care needs.

Comprehending Protection and Expenses

After very carefully examining and choosing the Medicare plan that finest fits their health care requires, people have to then comprehend the insurance coverage and prices related to their selected plan. Medicare insurance coverage can differ relying on the sort of plan, varying from Original Medicare (Part A and Part B) to Medicare Benefit strategies (Part C) and prescription drug coverage (Part D) It see post is important for recipients to assess their plan's Recap of Advantages and Protection, which lays out the services covered, any kind of limitations or constraints, and connected costs.

Comprehending the prices connected with Medicare is crucial for people to successfully manage their healthcare costs. Medicare Component A normally has an insurance deductible for hospital stays, while Part B has a regular monthly premium and a yearly insurance deductible. Medicare Benefit plans might have added prices such as copayments, deductibles, and coinsurance - Medicare supplement agent in Massapequa. Prescription medication protection under Part D likewise has its own set of expenses, including a month-to-month premium, annual insurance deductible, and copayments or coinsurance for drugs.

To make the many of their advantages, individuals must think about elements such as their healthcare needs, budget plan, and preferred medical care service providers when selecting a Medicare plan. Furthermore, remaining notified concerning any type of adjustments to coverage and prices every year is important to make sure individuals are obtaining the very best worth and maximizing their Medicare advantages.

Tips for Making Best Use Of Benefits

To optimize their Medicare advantages, people can employ numerous methods to optimize coverage and decrease out-of-pocket prices. One reliable suggestion is to meticulously review and compare various Medicare plans throughout the open registration duration. By evaluating their medical care needs and contrasting strategy choices, individuals can choose a strategy that offers comprehensive protection for their specific medical problems and prescription medicines. Additionally, it is recommended to frequently go to medical care suppliers that participate in the Medicare program. This makes sure that people receive the maximum benefits and reduces the probability of unforeseen out-of-pocket expenses. One more method to maximize Medicare benefits is to make the most of preventive services, such as annual health gos to and screenings. These solutions are generally covered at no price to the recipient and can aid spot potential wellness concerns beforehand, protecting against even more expensive therapies More hints in the future. People should consider registering in Medicare Part D prescription medication protection, even if they do not currently take prescription drugs. This can give valuable protection in case they need medicines in the future, staying clear of expensive out-of-pocket expenditures. By adhering to these tips, individuals can maximize their Medicare benefits and ensure they receive the healthcare they need without breaking the bank.

Final Thought

In conclusion, comprehending Medicare and its various parts is important in making the most of one's wellness insurance benefits. On the whole, being knowledgeable about Medicare can help people make notified choices and enhance their healthcare experience.

People who have actually functioned and paid Medicare taxes for at the very least 10 years are automatically eligible for Medicare Part A, which covers healthcare facility insurance coverage (Medicare agent near me). They may also select to sign up in Medicare Component B, which covers clinical insurance, and Medicare Component D, which covers prescription drugs

Medicare Component C, also understood as Medicare Advantage, is an alternate to Original Medicare (Components A and B) Medicare coverage can vary depending on the type of strategy, ranging from Original Medicare (Part A and Part B) to Medicare Benefit plans (Component C) and prescription medicine coverage (Part D) Medicare Component A typically has a deductible for healthcare facility keeps, while Component B has a monthly costs and an annual deductible.

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)